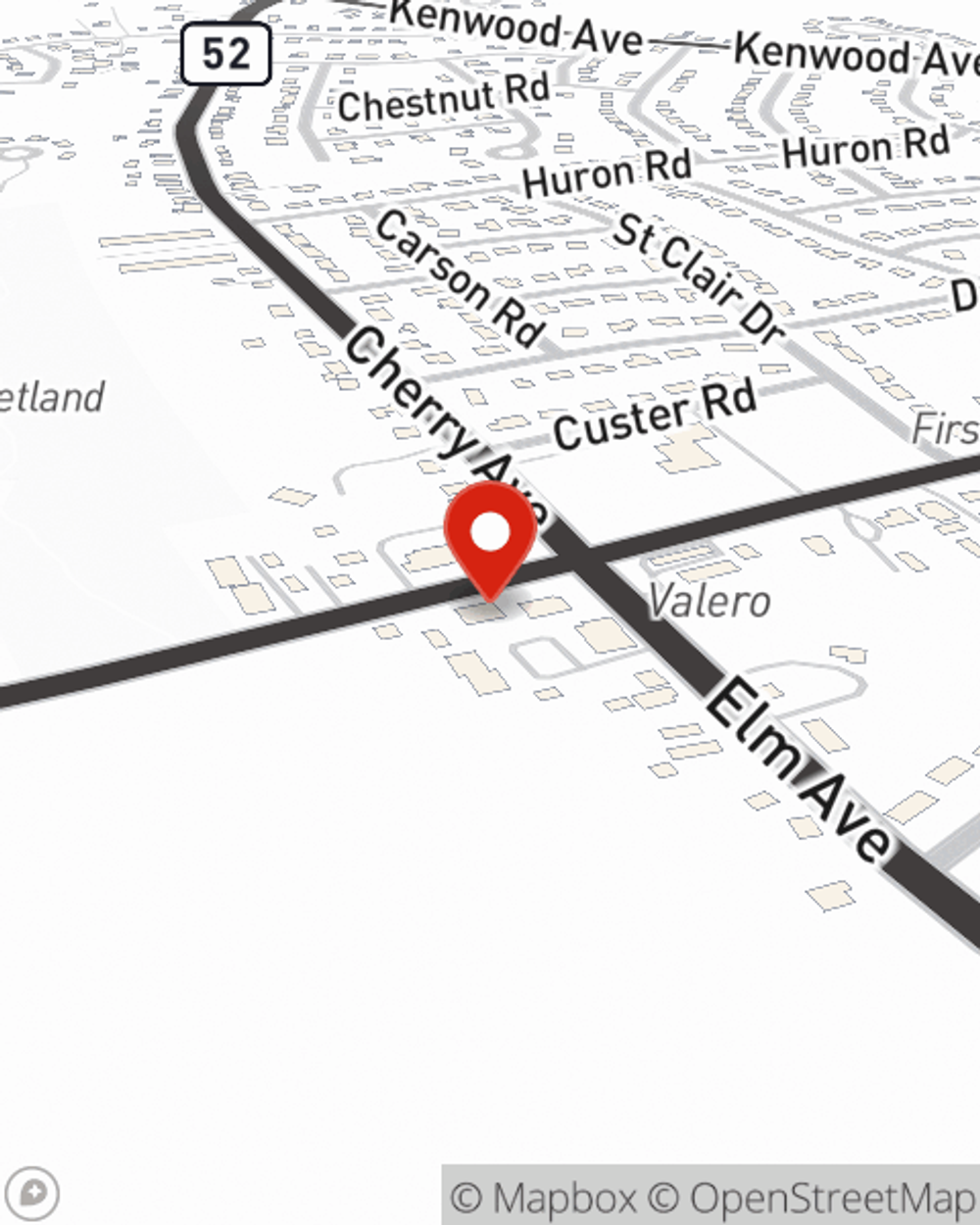

Life Insurance in and around Delmar

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

Be There For Your Loved Ones

No one likes to think about death. But taking the time now to arrange a life insurance policy with State Farm is a way to extend care to the people you're closest to if you pass.

Insurance that helps life's moments move on

Life happens. Don't wait.

Agent Erik Lachance, At Your Service

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Erik LaChance. Erik LaChance is the compassionate representative you need to consider all your life insurance needs. So if the worst happens, the beneficiary you designate in your policy will help your family or your partner with bills and other expenses such as childcare costs, utility bills and home repair costs. And you can rest easy knowing that Erik LaChance can help you submit your claim so the death benefit is issued quickly and properly.

Don’t let the unexpected about your future keep you up at night. Reach out to State Farm Agent Erik LaChance today and see how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Erik at (518) 621-1044 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Erik LaChance

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.