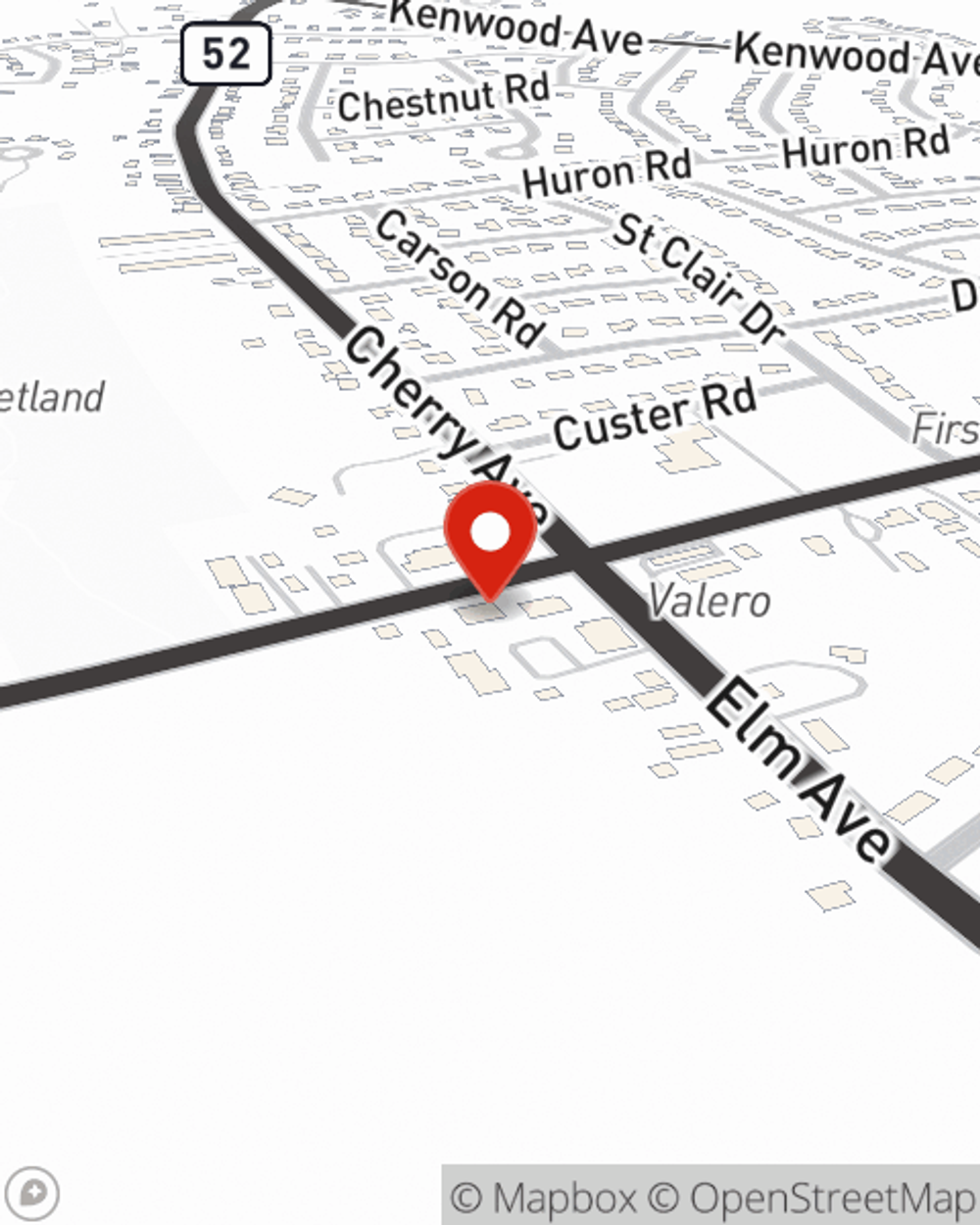

Condo Insurance in and around Delmar

Here's why you need condo unitowners insurance

Protect your condo the smart way

Condo Sweet Condo Starts With State Farm

When considering different deductibles, coverage options, and savings options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including electronics, sports equipment, furnishings, and more.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Agent Erik Lachance, At Your Service

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Erik LaChance can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

There is no better time than the present to call or email agent Erik LaChance and learn about your condo unitowners insurance options. Erik LaChance would love to help you select the smartest policy for you.

Have More Questions About Condo Unitowners Insurance?

Call Erik at (518) 621-1044 or visit our FAQ page.

Simple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Erik LaChance

State Farm® Insurance AgentSimple Insights®

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.