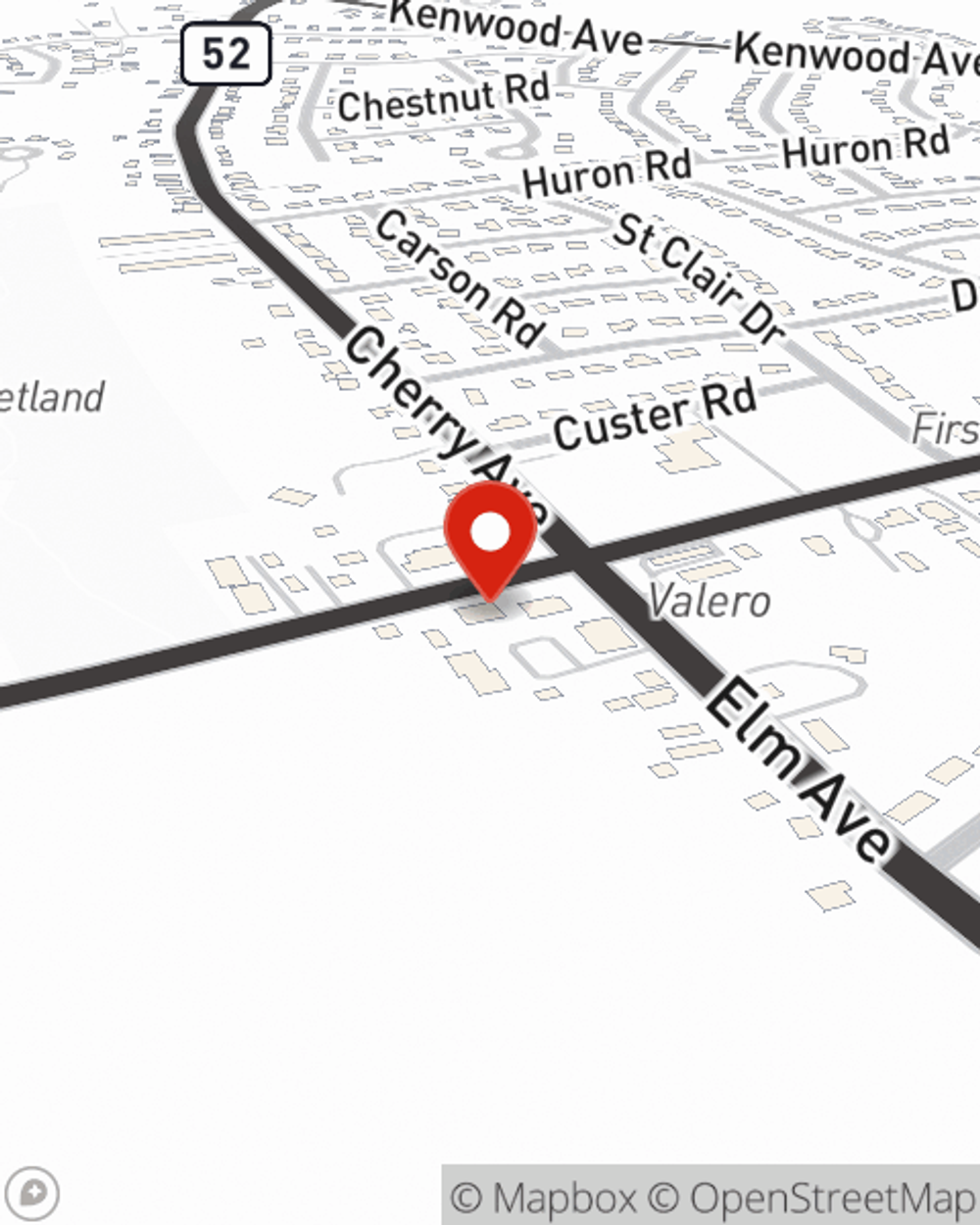

Business Insurance in and around Delmar

One of the top small business insurance companies in Delmar, and beyond.

No funny business here

Cost Effective Insurance For Your Business.

It takes courage to start your own business, and it also takes courage to admit when you might need help. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, business continuity plans and errors and omissions liability, you can feel confident that your small business is properly protected.

One of the top small business insurance companies in Delmar, and beyond.

No funny business here

Get Down To Business With State Farm

At State Farm, apply for the great coverage you may need for your business, whether it's a beauty salon, an ice cream store or a clock shop. Agent Erik LaChance is also a business owner and understands your needs. Not only that, but customizing policy options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage comes out on top.

Reach out agent Erik LaChance to explore your small business coverage options today.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Erik LaChance

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.